Analysts trace the drop to a shortage of Intel CPUs, a theory lent credibility by a 4.7% year-over-year increase in unit sales during the second quarter of 2019.

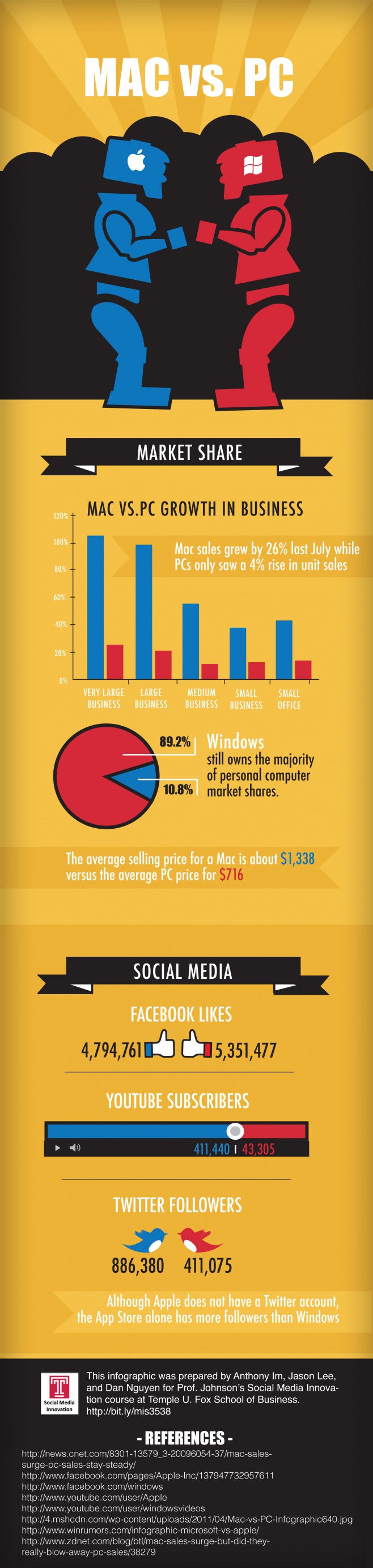

#Market share windows vs mac Pc

The PC industry reported a year-on-year increase in the second and third quarter of 2018, only to fall by 4.3% in the last quarter, which meant an overall decline of 1.3% compared to 2017.

It is not unusual for laptop makers to find themselves bidding for commercial contracts with multinational companies, supplying thousands, even tens of thousands of units. It is no coincidence that the top laptop sellers also have a strong presence in the PC market. When purchasing managers select a PC brand, they negotiate for laptops as part of the same contract. The PC industry increasingly focuses on volume buyers like governments and corporations. The industry sets its goals high when making devices affordable and accessible to the widest array of users.Ī strong presence in the desktop PC industry turns out to be a good thing for laptop makers.

Laptop vendors must struggle to keep up with ever-changing technological developments and innovations, coming to terms with 5G network technology, augmented reality, and more. Market share is static, but technology isn’t. Judging by laptop sales statistics, the three or four top companies seem well-positioned to retain their dominance and continued sales. Laptop market share is shared by a handful of players. Will laptops survive in the shrinking space between PCs and smartphones? It’s hard to say. And small, inexpensive laptops directly compete with tablets.

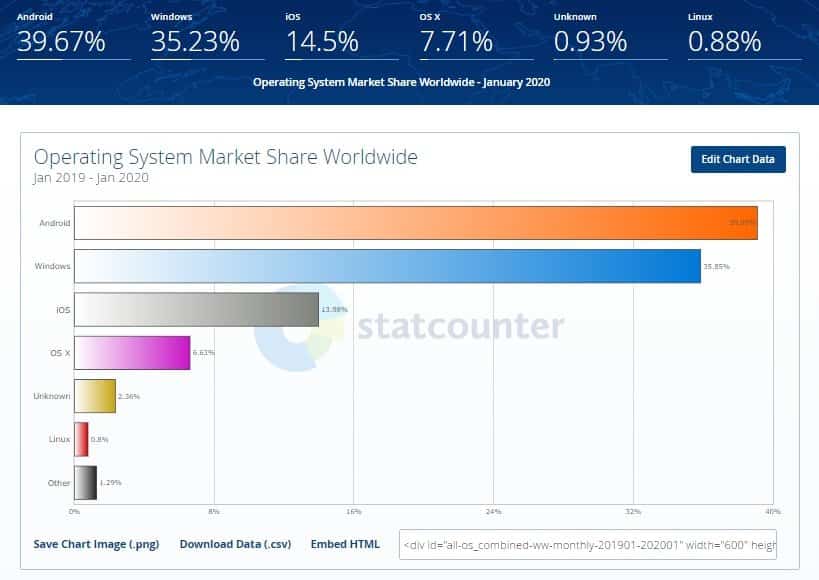

#Market share windows vs mac software

There seems to be an ongoing need for high-end notebooks capable of performing demanding tasks like gaming and software development. Laptops fall somewhere in between PCs and smartphones. That is why the only two consumer groups still purchasing PCs are gamers and high-income professionals. The technology swept the market by storm, causing a significant decline in personal computer sales of all kinds. Robust desktop PCs are still key for business enterprises and government institutions all over the world, as smartphones and tablets are not yet able to match their power. As early as 2015, 13.5% of the world’s population owned a tablet. For seven years in a row, PC sales (laptops included) have been on the decline as consumers do more and more of their computing with smartphones and tablets. The PC industry faces a number of challenges. The laptop market’s continued expansion is due to the ever-spreading internet grid, rising disposable incomes, swelling global population, and increasing interest among consumers, especially outside Europe and North America. Unit shipments are projected to rise at a CAGR of 1% to be registered during the same period. Companies like Toshiba, MSI, Microsoft, and Samsung also rank high, accounting for a combined 13% of global laptop market share in 2017. According to a study conducted by Grand View Research, global laptop sales are estimated to expand at a compound annual growth rate of just 0.4% through 2025. The market was dominated by six large PC manufacturers: HP, Lenovo, Dell, Apple, ASUS, and Acer. Global laptop sales totaled $101.7 billion in 2017, with 161.6 million units shipped worldwide. The laptop market is very narrow, with the three top vendors accounting for 60% of unit shipments. Unless you’ve wandered into an Apple store, of course. Walk into a tech store anywhere and you’ll see the same five or six laptop brands on the shelves.

0 kommentar(er)

0 kommentar(er)